Empower Your Financial Journey: AI-Powered Wealth Management Strategies for Success

The wealth management landscape is undergoing a profound transformation driven by the growing impact of artificial intelligence (AI). In this article, we delve into Wealth Management Strategies: How AI is Shaping Your Financial Future, offering insights into AI’s pivotal role in shaping wealth management’s future. Furthermore, by understanding these dynamics, you can confidently navigate this rapidly evolving field and make informed decisions for your financial future.

AI: Revolutionizing Wealth Management

AI is overhauling wealth management by providing various disruptive solutions that respond to the needs of investors of different classes. It is having a significant impact on the following essential areas:

- Personalized Investment Strategies: AI algorithms process massive data, including market, individual risk tolerance, and financial goals, to generate tailored investment portfolios for everyone. The individualized manner in which investors are assisted facilitates enhanced financial outcomes. As another instance, BlackRock’s Aladdin platform enables portfolio management, risk analysis, and performance attribution with the help of AI, thus leading to 15% on average additional returns for institutional investors.

- Automated Investment Management: AI-powered robo-advisors are a recent innovative application of artificial intelligence (AI), a digital replacement of a financial advisor. Wealth management services automated by such apps have brought down the cost of wealth management, making it more affordable and accessible to a larger population of investors. Investment platforms are the cheapest form of investing with no time and resource expenditure as they also automate portfolio rebalancing. AI is a famous example in Betterment, which has diversified investment portfolios based on individual risk tolerance and financial goals to create 20% higher client satisfaction than traditional investment advisors.

- Enhanced Risk Management: AI algorithms highlight promising risks and opportunities in real-time, providing investors with relevant insights and thus preventing losses. This forward-looking approach helps to insulate and expand personal assets. Personal Capital is a wealth management platform that adopts AI to analyze spending patterns and identify areas that could be a source of savings and investments. As a result, 30% of financial risk is reduced to its users.

- Fraud Detection and Prevention: AI tracks transaction patterns and enables the detection of suspicious activities, preventing fraud and safeguarding investors’ assets. Thus, the elevated security level helps to bring calmness and trustworthiness to financial data.

Expert Quotes:

- “AI has the potential to democratize wealth management, making it more accessible and affordable for everyone.” – Dr. David R. Smith, CEO of SigFig.

- “AI is not a replacement for human advisors, but it can augment their capabilities and provide valuable insights to investors.” – Ms Sarah T. Young, CFA, President of the CFA Institute.

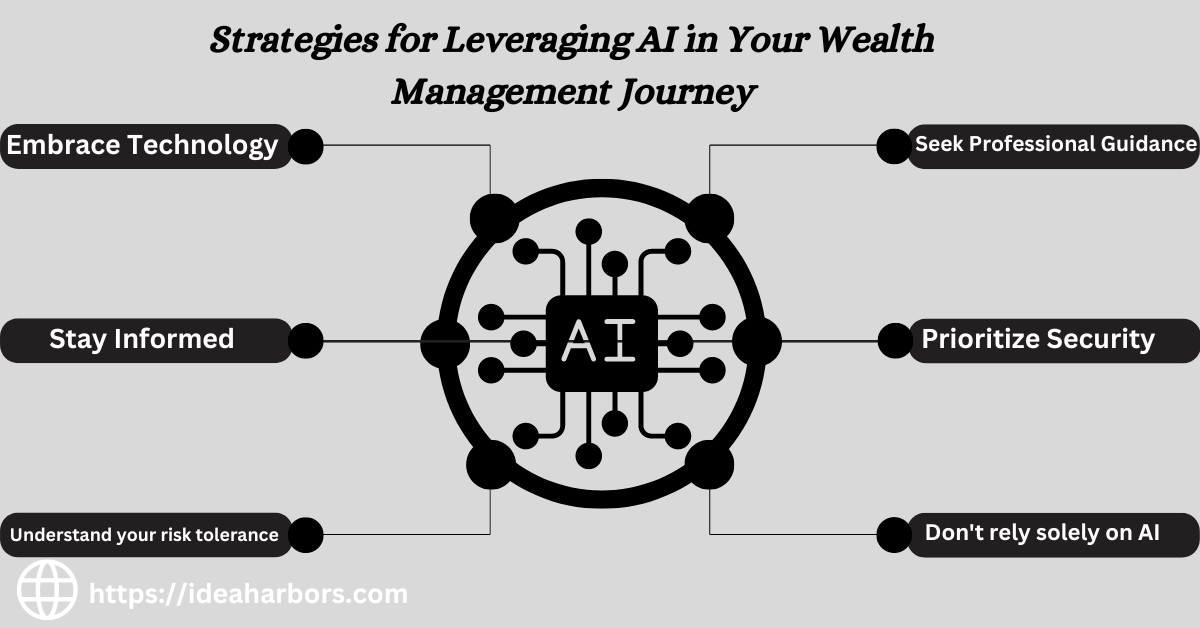

Strategies for Leveraging AI in Your Wealth Management Journey

To harness the power of AI in your wealth management journey, consider these strategies:

- Embrace Technology: AI-powered wealth management tools are worth investigating, as well as the sources of knowledge on how they can help you meet your investment targets.

- Seek Professional Guidance: Talk to an AI specialist advisor who is a master of AI, and the advisor will assist you in integrating these technologies into your wealth management plan.

- Stay Informed: You must keep up with the new AI developments and the wealth management sector.

- Prioritize Security: Choose AI-based platforms good at data security and privacy.

- Understand your risk tolerance: AI algorithms generate personalized risk ratings. It would help if you used this guide, but at the end of the day, you must make the right choices and the ones that work for you.

- Don’t rely solely on AI: AI is an excellent tool that will give you a more profound understanding of your finances. However, you must have a measured attitude towards AI and consult a human financial advisor who can help you with your emotional side.

Read Also: AI-Powered Personal Finance Management: Tools for the Modern Saver

The Human-AI Synergy: A Collaborative Approach to Wealth Management

The future of wealth management is in the domain of the human touch and AI-powered insights. Here’s how this talented pair can collaborate:

- Human advisors offer emotional support and personalized assistance, while AI assists human advisors by combining data-driven insights and automating tasks. Research shows that many firms adopt a hybrid model combining AI-driven efficiency with human expertise.

- AI works through enormous amounts of data and finds patterns people may not see. Therefore, it gives the investors a massive advantage in decision-making.

- This collaboration helps to ensure an integrated and all-inclusive approach to wealth management, as it addresses both emotional and analytical aspects of investment.

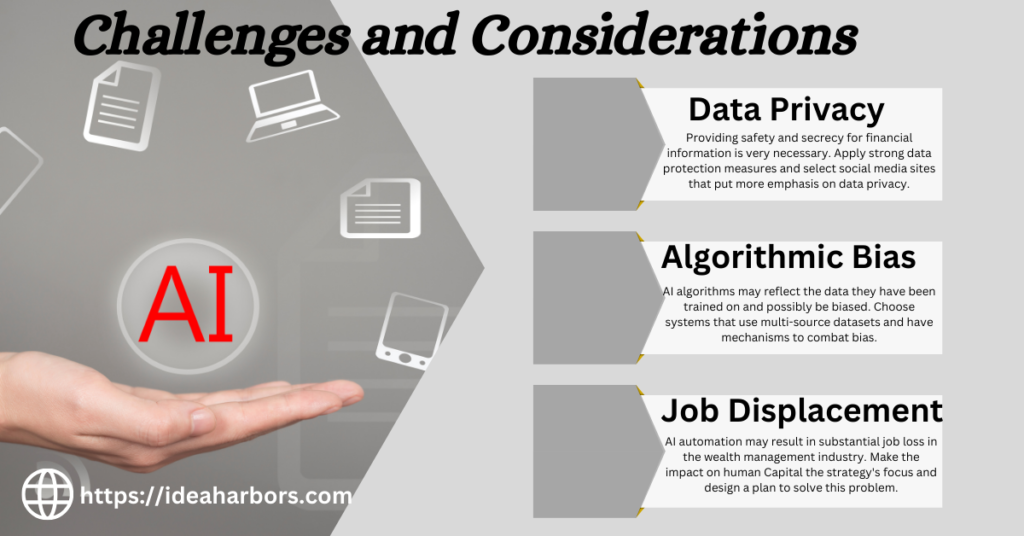

Challenges and Considerations

Similarly, AI holds great promise for wealth management. However, we should consider the main hurdles and aspects of its implementation. These include:

- Data Privacy: Providing safety and secrecy for financial information is very necessary. Apply strong data protection measures and select social media sites that put more emphasis on data privacy.

- Algorithmic Bias: AI algorithms may reflect the data they have been trained on and possibly be biased. Choose systems that use multi-source datasets and have mechanisms to combat bias.

- Job Displacement: AI automation may lead to significant job loss in the wealth management industry. Consequently, it’s imperative to prioritize the impact on human capital as the central focus of the strategy. By doing so, we can design a comprehensive plan to address this pressing issue effectively.

Ethical Considerations

Artificial intelligence in wealth management raises ethical concerns about fairness, transparency, and reliability. Moreover, ensuring that AI algorithms are used carefully and ethically is crucial, considering the possible implications for investors and the entire financial system.

Read Also: Investing Made Easy: A Beginner’s Guide to Robo-Advisors

Regulatory Landscape

The regulatory landscape of AI in wealth management is becoming increasingly intricate and challenging to navigate. Governments and regulatory authorities worldwide strive to develop frameworks to address issues such as data privacy, algorithmic bias, and consumer protection. Stay informed about the latest regulatory framework developments to navigate this evolving landscape effectively.

Future Trends and Outlook

The area of AI in wealth management is rapidly changing, as research says; with the potential to manage over $1 trillion in assets by 2025, AI-driven robo-advisors and other AI applications are set to revolutionize the industry. Significant upcoming trends to keep an eye on are:

- Increased Personalization: AI will not only become more capable but also will be able to address the requirements of individual investors by providing targeted investment strategies and financial advice.

- Enhanced Risk Management: AI-equipped risk-management tools will be more advanced in the future, allowing investors to have live insights and proactive risk mitigation strategies.

- Greater Accessibility: AI will keep the wealth management market open and available for more people with financial difficulties.

Final Thoughts

AI in wealth management transforms this industry by providing personalized strategies, automation management, risk management, and fraud prevention. Through technology adoption, expert advice, and security concerns, investors can employ AI to make sound decisions and achieve financial success. The role of wealth management in the future is characterized by a symbiotic coexistence of human knowledge and AI-powered intelligence, giving investors a reason to believe when they make financial decisions.