Investing Made Easy: A Beginner’s Guide to Robo-Advisors

Entering the investing world can feel gorgeous, mainly for those new to the field. Fortunately, technology has provided a clarification: robo-advisors. Robo-Advisors: Tailored Investment Advice for the Digital Age. Furthermore, these digital platforms offer an accessible and proper way to start your investment campaign, even with limited experience or capital.

What are Robo-Advisors?

Imagine having an individual investment expert existing at your fingertips, 24/7. That’s necessarily what robo-advisors offer. These online platforms use leading algorithms to create and manage customized investment cases based on your goals, risk resilience, and financial situation. Research has shown that robo-advisors can build varied portfolios and generate competitive returns, making investing simple and accessible, especially for those with little to no experience in financial planning.

How Do They Work?

Getting started is simple. Initially, you’ll commonly answer several questions about your financial position. Subsequently, you’ll delve into your investment goals, such as saving for stepping down or making an advance payment on a house. Furthermore, you’ll assess your comfort level with risk. With your input, the robo-advisor’s algorithm will begin to grow the portfolio using inexpensive ETFs (exchange-traded funds) and holdings across different asset classes, including bonds and stocks.

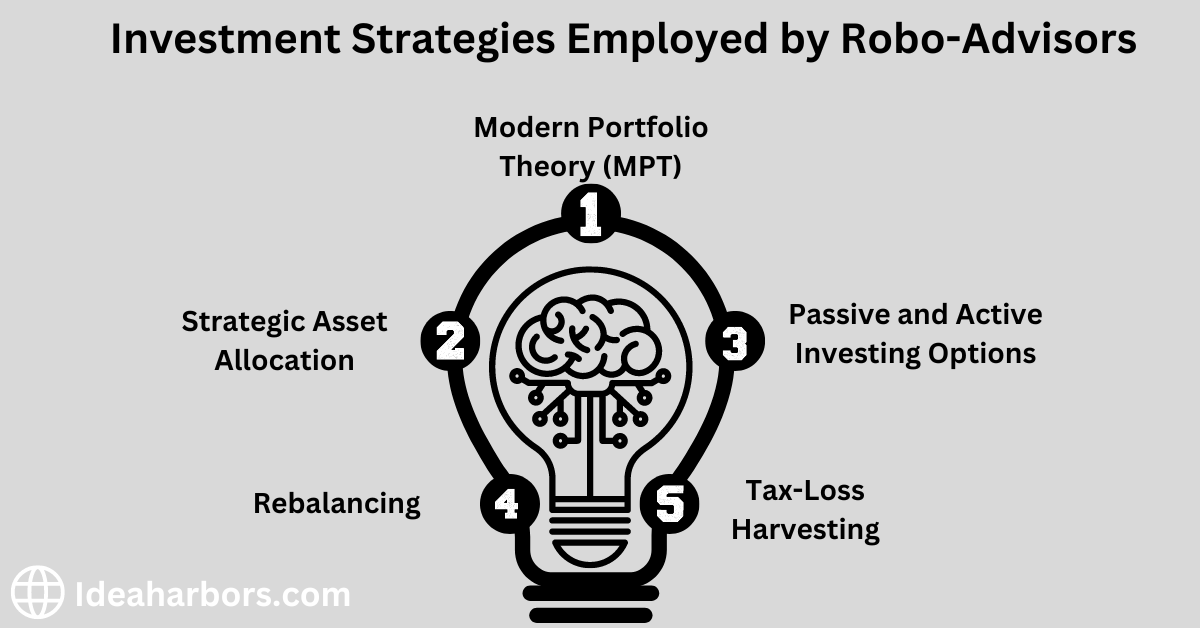

Investment Strategies Employed by Robo-Advisors

While specific strategies may vary between platforms, robo-advisors generally follow these core principles:

- Modern Portfolio Theory (MPT): This hypothesis concentrates on maximizing returns given a pre-ordained level of risk by diversifying investments across several asset classes with a relatively weak dependency.

- Strategic Asset Allocation: Robots-advisors incorporate the optimal ratio of assets between risky and less risky. They base their calculations on your risk tolerance and time horizon.

- Passive and Active Investing Options: Most platforms use low-cost index funds and ETFs that track a particular market index as their primary tool, allowing them to follow the market rather than outrun it. In contrast, a few robo-advisors allow investing in managed funds or strategies that are actively involved instead of aimed at outperforming the market.

- Rebalancing: Portfolios are automatically rebalanced periodically to maintain the target asset allocation and manage risk.

- Tax-Loss Harvesting: This strategy involves selling investments with losses to offset capital gains and potentially reduce tax liabilities.

Popular Robo-Advisors: A Comparison

| Platform | Minimum Investment | Fees (Annual) | Key Features | Investment Strategies | Human Advisor Access | Historical Performance | Investment Options |

|---|---|---|---|---|---|---|---|

| Betterment | $0 | 0.25% – 0.40% | Goal-based investing, socially responsible investing options | MPT, Strategic Asset Allocation, Passive Investing | Yes, for premium clients | Competitive varies based on portfolio | Stocks, Bonds, ETFs |

| Wealthfront | $500 | 0.25% | Tax-loss harvesting, direct indexing, financial planning tools | MPT, Strategic Asset Allocation, Passive Investing, Tax-Loss Harvesting | Yes, for premium clients | Competitive varies based on portfolio | Stocks, Bonds, ETFs, Alternatives |

| Ellevest | $0 | 0.25% | Tailored to women’s financial needs, career coaching | Goal-based investing, Socially Responsible Investing | Yes, for premium clients | Competitive varies based on portfolio | Stocks, Bonds, ETFs |

| Schwab Intelligent Portfolios | $5,000 | 0.00% | Backed by Charles Schwab, access to human advisors | MPT, Strategic Asset Allocation, Passive Investing | Yes, for all clients | Competitive varies based on portfolio | Stocks, Bonds, ETFs |

| Vanguard Digital Advisor | $3,000 | 0.20% | Low-cost, diversified portfolios using Vanguard index funds | MPT, Strategic Asset Allocation, Passive Investing | Limited availability | Competitive varies based on portfolio | Stocks, Bonds, ETFs |

Addressing Algorithmic Bias and Data Privacy

Robo-advisor platforms are conscious of the potential for algorithmic bias and take a step ladder to alleviate this risk. These measures include engaging diverse development groups, conducting regular algorithm inventories, and clarifying how algorithms make investment judgments. Additionally, reputable platforms line up data privacy and security, applying measures to protect user information.

Read Also: AI-Powered Personal Finance Management: Tools for the Modern Saver

Human Advisor Integration and Potential Drawbacks

Some robo-advisor platforms offer access to human financial advisors for additional guidance and support. It can be helpful for investors with complex financial positions or those seeking personalized guidance beyond automated references. However, it’s essential to consider potential weaknesses, such as limited customization options or the lack of human collaboration on specific platforms.

Performance, Fees, and Risk Management

While historical pieces can vary, robo-advisors generally target to deliver competitive returns that line up with market standards. However, it’s important to remember that historical performance does not indicate future outcomes, and all investments convey some risk. Consider the fee configuration and potential waves on your investment returns over time. Robo-advisors manage risk through diversification and automatic balancing, which prevents untold losses and ensures that your calculated risk tolerance and portfolio are balanced.

Emerging Trends in Robo-Advisory

The robo-advisor domain has been experiencing a great deal of change recently. New functions and technologies have emerged, including, among others, the improvement of user experience and investment results.

- Integration of Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are leveraged to tailor-make investment approaches, proactively distribute assets, and refine risk management mechanisms. AI can do this by, for instance, analyzing market data to determine trends and patterns that can affect the decisions on how to make investments.

- Expansion of Investment Options: Whether it is through a separate investment different from the traditional stocks, bonds, real estate investment trusts (REITs), and commodities, these platforms allow many more investment options to diversify your portfolio.

- Enhanced Financial Planning Tools: Robo-advisors are going further and are integrating more complex financial planning tools, which might be calculators for retirement, software that tracks spending and provides educational material to help users define their goals, monitor their progress, and make well-informed decisions on their finances.

Conclusion

Compelling the first step into the spending world can feel overwhelming, but robo-advisors offer a valued clarification for beginner investors. These platforms authorize you to take control of your economic future and work to succeeding your long-term financial goals by providing a reachable, reasonable, and automatic approach to investment organization. Remember, the key to success is to start early, stay reliable, and choose the platform that aligns with your distinct needs and preferences.

Read Also: Ideaharbors.com: Pioneering Creativity and Collaboration