AI: The Key to Unlocking Financial Inclusion for 1.7 Billion People

All the financial inclusion of the world’s unbanked population will be of primary concern to the 7 billion people who cannot get essential financial services. This problem creates barriers to personal economic advancement, extends poverty, and hinders social development. Financial Inclusion: AI Solutions for the World’s Unbanked Populations holds the potential to revolutionize accessibility to financial services, offering innovative solutions that are essential for economic development and poverty alleviation.

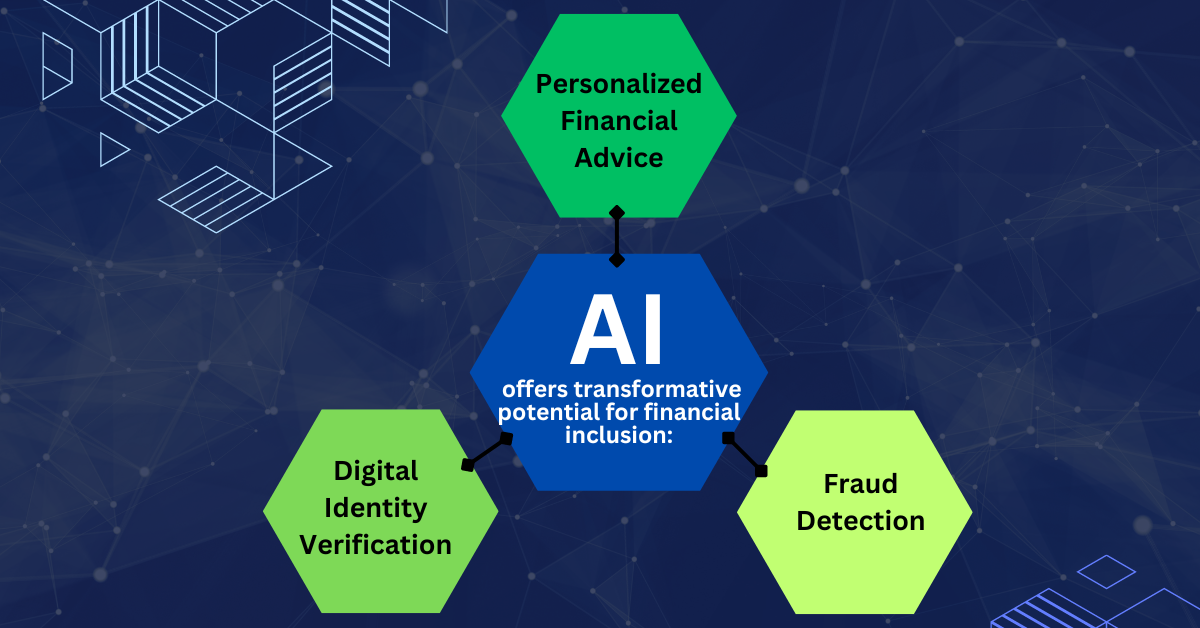

Artificial Intelligence (AI) offers transformative potential for financial inclusion:

- Personalized Financial Advice: Artificial intelligence can handle financial data by determining a person’s future income and expenditure trends, and then it can give personalized recommendations on saving money, debt management, and investing.

- Digital Identity Verification: AI can verify identities without identification papers, using facial recognition technology, and as a consequence, financial services will be accessible without complex bureaucratic procedures.

- Fraud Detection: AI technologies can identify irregularities in financial transactions that might be used for fraud, which keeps consumers safe from financial scams. These are especially relevant in developing countries with limited fraud detection methods.

Read Also: Empower Your Financial Journey: AI-Powered Wealth Management Strategies for Success

Case Studies:

- M-Pesa, a mobile money transfer platform that is a Kenya product with AI as a critical enabler, has revolutionized financial inclusion in Kenya. The tool will allow individuals to carry out transactions such as sending and receiving payments, bill payments, and banking on their mobile phones. It will be great for the areas that lack the banking infrastructure since it will give the people a chance to succeed financially.

- A non-profit organization, Kiva, applies AI to connect borrowers with lenders. As a result, residents of developing countries can now get microloans for different purposes. The system’s AI algorithms analyze creditworthiness using alternative data sets, thereby increasing the chances that informal financial system users will get access to the formal financial system.

Benefits and Challenges:

While AI has the potential to democratize access to financial services, improve financial literacy, and reduce poverty, it also presents challenges:

- Data Privacy: While it is relevant that we reinforce the need for a high level of data privacy and security, an individual’s privacy is also essential.

- Bias and Discrimination: Guaranteeing the AI algorithms’ transparency and the AI systems’ accountability is mandated to prevent such unjust and discriminatory treatment.

- Accessibility and Affordability: However, one of the main problems is ensuring that AI in financial services is a low-cost and accessible tool for the poor and low-income people.

Ethical Considerations:

Ethical dimensions are the most crucial issue we should be concerned about alongside AI and finance. Transparency and accountability in AI algorithms must be prioritized to ensure fairness and avoid discrimination. Strong data privacy and security measures are the key factors in guarding a person’s information. Moreover, AI should be employed with caution and ethical standards in mind, which is necessary to ensure proper human control. Additionally, the research says that Organizations must develop a strong AI mindset and capability to navigate these challenges.

Impact on the Financial Sector and Workforce:

The financial sector will be redesigned, and AI will be behind it. The new system will be more efficient and inclusive on the one hand, and on the other, it will reduce job opportunities. The role of AI in relieving the staff of repetitive work will change the workflow, and the management of data and AI should be the primary focus. Consequently, the employees should also be upgraded to stay competitive.

Read Also: AI-Powered Personal Finance Management: Tools for the Modern Saver

Addressing the Digital Divide:

The main obstacle that the digital divide creates for financial inclusion is that many people need help using digital technologies. Infrastructure development and technology are conditions, especially in rural and underserved areas. Governments and organizations can become significant players in narrowing this difference.

The Role of Collaboration:

Partnerships between AI companies, financial institutions, and government agencies can promote financial inclusion. Working together can overcome any obstacle and put into successful practice initiatives.

Read Also: Investing Made Easy: A Beginner’s Guide to Robo-Advisors

The Future of AI in Financial Inclusion:

The future of financial inclusion has technologies that include blockchain and the Internet of Things (IoT), which can address data challenges, improve accessibility, and ensure financial literacy. AI is a unique tool that can be a winner in the financial sector and democratize financial services. However, with suitable investments in talent and technology, financial exclusion could become a thing of the past by 2025 or 2026

Policy Recommendations:

Governments and financial institutions must create regulations that enhance accountable and sustainable AI development for equitable banking services. This includes data privacy laws, ethical guidelines for machine learning algorithms, and projects that advocate overcoming the digital divide.

Conclusion:

AI may become the change-maker in the process of financial inclusion. However, it has challenges. The solution to these problems will help us use AI to develop a fairer and more inclusive economic environment for everyone. Individuals, organizations, and policymakers can lead in driving the right changes by encouraging initiatives that promote responsible development of Artificial Intelligence, fostering collaboration, and giving the unbanked people the power to their financial well-being.

While we are walking on this path, we need to bear in mind the use of clear and concise language, cite evidence for our claims, provide visuals to explain our points, consider case studies and real-world examples, and be aware of our diversified audience. The lane is endless, but the objective is worth the effort.